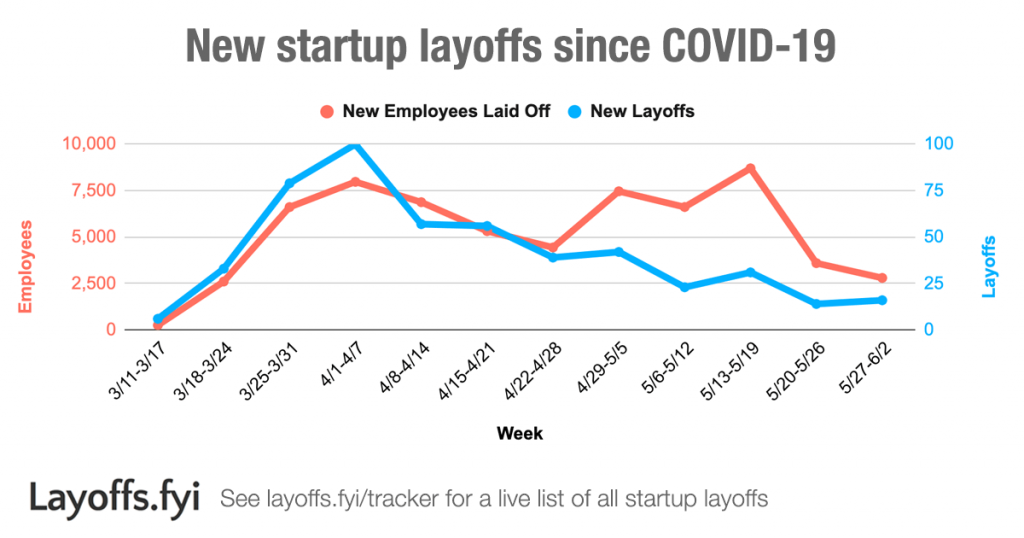

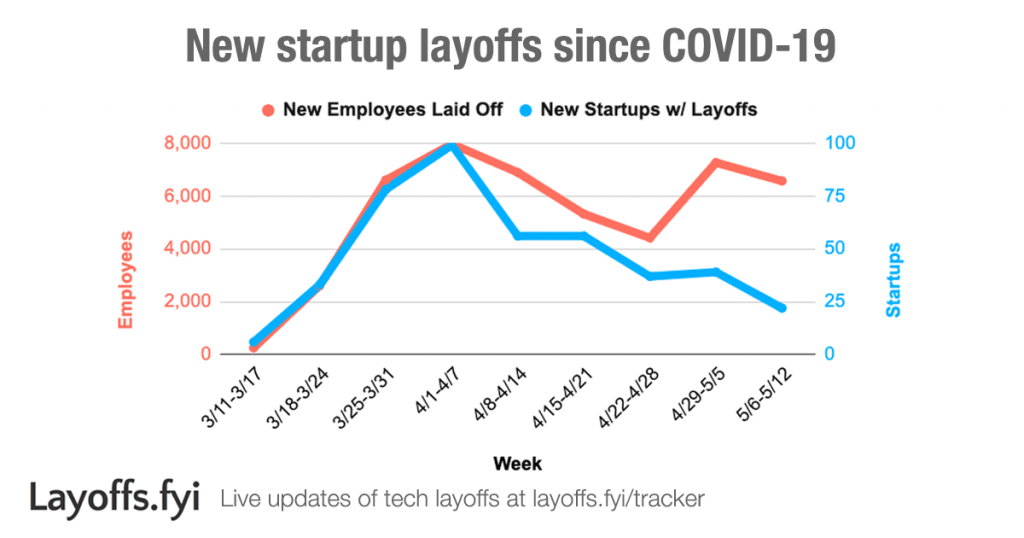

It’s been a roller coaster year for tech 🎢. In the month of April alone, 269 startups laid off 26,651 employees, unsure if they’d ever be able to raise money again.

Now? Fundraising and IPO markets are at their frothiest levels since the dot-com era. We end the year with just 4 recorded layoffs in December.

Even startups that cut employees earlier in the year have rebounded. Here are our Top 10 layoff comeback stories of 2020 – or, view the Layoffs.fyi Tracker to catch up on all the layoffs that happened this year.

10. ![]()

How it started: Reportedly laid off 60% of employees in April

How it’s going: Announced in August that it bought a competitor, brought back some of its laid-off employees, and is hiring again

9. ![]()

How it started: Laid off 40 employees (15%) in May

How it’s going: Raised $85 million in July at a “significant step up” from its previous valuation

8. ![]()

How it started: Laid off 400 employees (33%) in March

How it’s going: Raised $170 million in June at an increased valuation of $1.3 billion

7.

How it started: Laid off or furloughed 2,100 employees (35%) in April

How it’s going: Announced in July that it would bring back “nearly all” of its furloughed employees. Its stock price has rebounded 113% from its pandemic low

6. ![]()

How it started: Laid off 21 employees in April

How it’s going: IPO in December via SPAC, now trading at a market cap of $7 billion

5. ![]()

How it started: Laid off 100 employees (33%) in April

How it’s going: In November, announced plans to IPO in Q1 2021 via SPAC

4. ![]()

How it started: Laid off 50 employees (10%) in May

How it’s going: Acquired by Twilio for $3.2 billion in November

3.

How it started: Laid off 161 employees (16%) in April

How it’s going: Doubled its valuation in a $180 million funding round just one month later

2. ![]()

How it started: Laid off 600 employees (35%) in April

How it’s going: IPO in December via SPAC, now trading at a market cap of $13 billion

1.

How it started: Laid off 1,900 employees (25%) in May

How it’s going: IPO in December, now trading at a market cap of nearly $100 billion(!)

Honorable mentions: Lattice, Pipedrive, Grab, Parsable, Hibob, Aqua Security

Of course, not all companies have had such an unexpected reversal of fortune. Plenty of startups are still struggling, not to mention the pandemic’s continued toll on the broader economy and human lives.

Here’s hoping for a brighter and less volatile 2021 💉. Happy new year!