Posted by Roger Lee

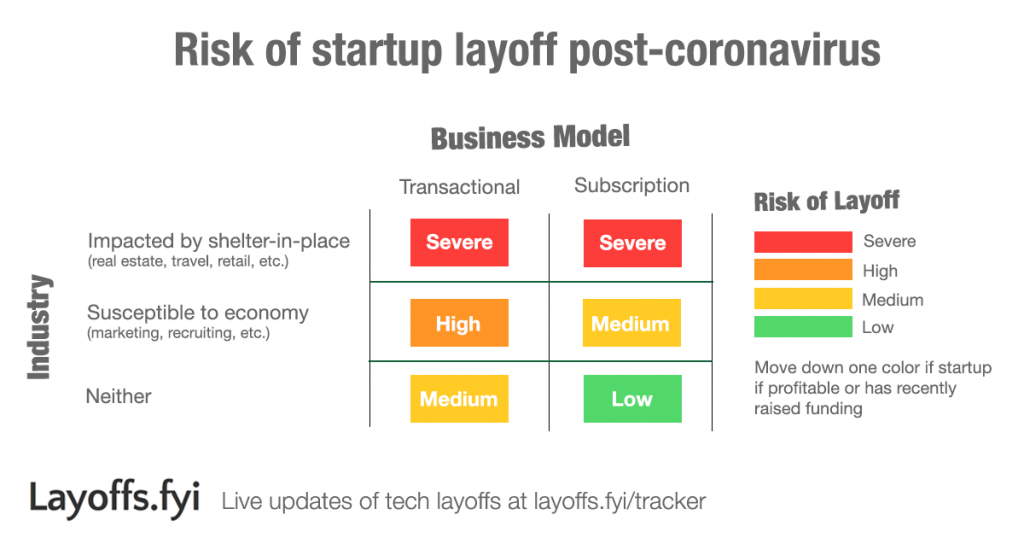

Key takeaway: The 3 factors driving startup layoffs post COVID-19 are: (1) industry (is it impacted by shelter-in-place?), (2) business model (is it transactional?), and (3) cash runway.

Sadly, startup layoffs have been happening at a dizzying pace. Last week, Opendoor laid off 600 employees (35%), Carta laid off 161 employees (16%), and Greenhouse Software laid off 120 employees (28%). The week before, Toast laid off 1,300 employees (50%), Eventbrite laid off 500 employees (45%), and ezCater laid off 400 employees (44%).

In this post, I’ll attempt to explain the 3 main factors driving the 277 startup layoffs we’ve witnessed since COVID-19. My hope is to help startup employees understand why layoffs have been happening, and how your own company might be thinking about this decision.

First, some background. My name is Roger Lee and I created Layoffs.fyi as a project to track all startup layoffs since COVID-19.

As of today (4/21/20), the Layoffs.fyi Tracker has confirmed 277 startups w/ layoffs and 26,087 employees laid off since the coronavirus was declared a pandemic on 3/11. There’s many more that haven’t been reported.

With a month of data, I decided to analyze the trends to better understand: why all the startup layoffs, and what’s been driving them?

Why all the startup layoffs?

Given how the pandemic has unfolded, it’s not surprising we’ve seen so many layoffs (at least, in hindsight). Startups are generally unprofitable and rely on funding from venture capitalists. VCs hope their investment will lead to fast revenue growth.

When an external shock like the coronavirus hits, the economy slows down. Businesses and consumers pull back spending, leading to lower revenue growth for startups. Startups then conduct layoffs to realign costs with their lowered revenue.

Startups also fear they can no longer depend on a robust fundraising environment, so they conduct layoffs to make their existing cash last longer.

What factors make a startup layoff more likely?

That said, the pandemic hasn’t treated all startups equally. Even as many startups have done layoffs, there are others that are still hiring or even thriving (like those in remote work, food delivery, etc.). What attributes of a startup make it more likely to do a layoff?

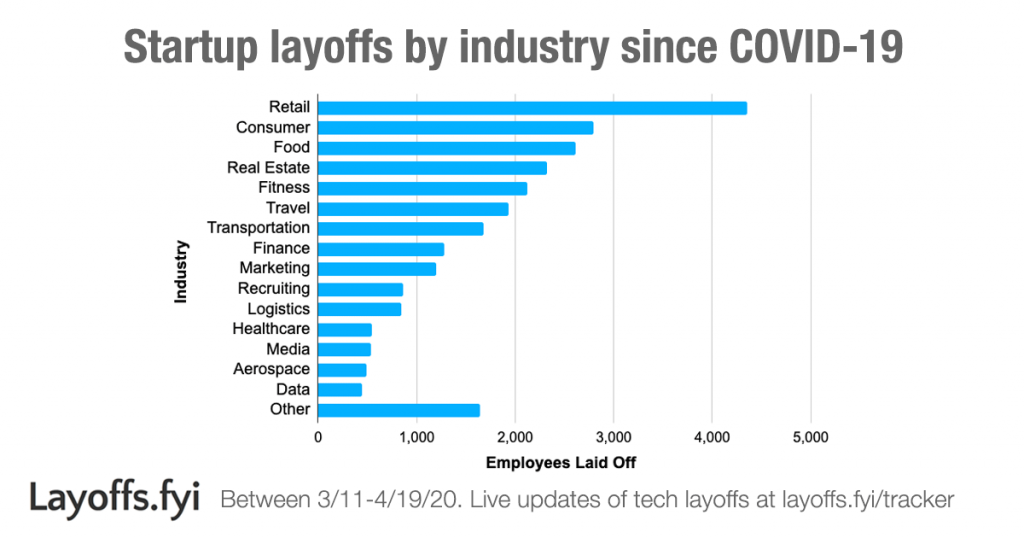

As a starting point, Tomas Tunguz at Redpoint Ventures analyzed the Layoffs.fyi data to determine which industries were most impacted by the coronavirus. His blog post is worth a full read, but here’s the takeaway:

If we tally the reductions by category, travel, retail, fitness, real estate, transportation, and recruiting constitute the top 6 categories. Aside from recruiting, these are all consumer discretionary spend categories. ClassPass, one of the fitness startups to reduce headcount, reported a 95% drop in sales in 10 days. The lockdowns have reduced foot traffic by 50% or more.

Software startups sold to human resources, security, legal, IT, and product teams are at the bottom of the list. Because sales cycles in software are slower, we should expect a higher latency before seeing reductions in force in those categories. In consumer discretionary categories, changes in spending appear immediately at the till.

Factor 1: Industry

In other words, industries directly affected by shelter-in-place orders are most likely to do a layoff. Over 2/3 of startup employees laid off have come from these industries. Examples include car-sharing startup Getaround (100 employees, 25%), e-scooter startup Bird (406 employees, 30%), and short-term apartment rental startup Sonder (400 employees, 33%).

However, industry alone doesn’t paint the full picture. Not all startups in shelter-in-place industries have conducted layoffs. And 1/3 of employees laid off have come from other industries.

Besides industry, I’ve observed two other factors that can explain the likelihood of a layoff.

Factor 2: Business Model

Many startups with layoffs have said that the coronavirus caused an immediate and dramatic dip in revenue. Fitness startup ClassPass said that 95% of its revenue has dried up. Local services startup Thumbtack said its business has fallen by over 50% in many markets. Ticketing company Eventbrite has seen “revenue projections fall off a cliff.”

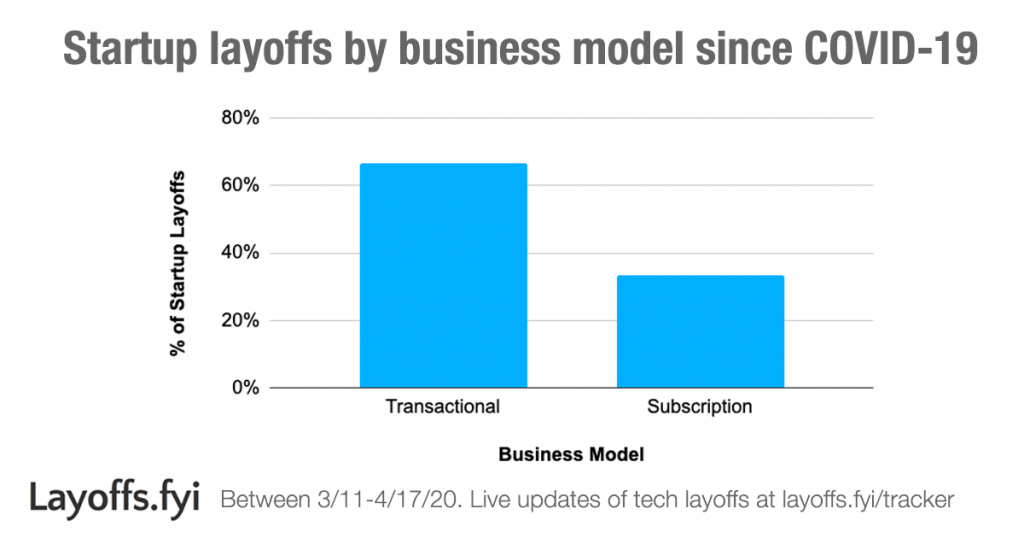

These startups all have a transactional business model, meaning they make money from one-time purchases, commissions, or transaction fees. Startups with a transactional business model are more susceptible to sudden declines in revenue because their revenue doesn’t automatically renew the way it does in SaaS. The startup needs to make new revenue-generating transactions every day in order to continue earning money.

On the other hand, startups with a subscription-based business model are more insulated from immediate revenue disruption. SaaS startups also typically sign customers to long-term contracts, so they have a time buffer before revenue could potentially shrink.

The Layoffs.fyi data shows that 2/3 of layoffs have occurred in startups with a transactional business model, compared to 1/3 in startups with a subscription-based business model.

This factor can explain why Marketing, Recruiting, and Finance startups have laid off the most employees outside of the industries directly affected by shelter-in-place. Marketing companies (like AdRoll and MediaMath) often make money per ad impression, click, or conversion. Recruiting companies (like ZipRecruiter and Triplebyte) usually make money per job post or hire placed. Finance companies (like Newfront Insurance and PeerStreet) often make money per loan/policy originated or as a percentage of assets. All of these are transactional business models, where revenue can drop quickly if the underlying activity slows.

Factor 3: Cash Runway

The final factor is how many months of cash the startup has left in the bank.

In a memo to employees, Bird’s CEO said that its layoff was needed “to ensure a cash runway to last through the end of 2021.” Zume’s CEO blamed its layoff on funding that fell through. Yonder’s CEO said its layoff “gives the company the runway…needed to weather this tough period.”

Startups don’t usually cite cash runway when they discuss their layoff publicly, but it’s almost always a key driver of their decision.

Reports suggest that the fundraising market has already cooled down. VCs are spending more time supporting their existing investments instead of making new ones. As a result, startups have been advised to make their existing cash last at least 18-24 months before needing another funding round.

For startups that raised money recently or are profitable, this is easier to do. But startups that last raised funding more than a year ago and were planning to raise again in 2020 are in a tougher situation.

If you see a layoff where the startup isn’t directly affected by shelter-in-place and also doesn’t have a transactional business model, it’s likely because the startup doesn’t think it has enough cash to survive a fundraising freeze.

Summary: The 3 factors that explain a startup layoff

Putting it all together, here’s a proposed framework for evaluating the likelihood of a startup layoff in this post-coronavirus environment:

Here’s hoping that the external circumstances improve quickly!